Life Insurance is the perfect solution

Whilst property investment in the UK remains an extremely attractive investment opportunity, there have been significant changes in recent years to the taxation of UK residential property held by offshore entities.

Historically, UK property owned by an offshore company which was owned either by a foreign domiciled person (“non-dom”) or by a trust set up by a non dom would fall outside IHT and would be treated as ‘excluded property’.

However, since 6th April 2017, inheritance tax is charged on UK residential property where it is held directly or indirectly by any individual or trust and this includes properties held through an offshore structure, such as a company.

The new charge applies both to individuals who are domiciled outside the UK and to trusts with settlors who are non-UK domiciled.

The new legislation means that even though the property may be ‘enveloped’ and the owner of the offshore company may be non-dom or be held in a trust set up by a non-dom, there will still be a liability to UK inheritance tax at 40%.

The tax due will be on the value of the company at the time of their death or (in certain cases) every ten years. Furthermore the legislation extends to loans made by non doms to trusts or relatives to purchase UK residential property.

Responsibility for paying the IHT liability will vary depending on whether the enveloped property is owned by the deceased or in a trust but broadly it will fall on the executor of the estate and the heirs as well as on the trustees of any trust and the beneficiaries of that trust.

HMRC have power to charge the UK property itself with any inheritance tax due and the time limits for collection of inheritance tax are up to 20 years (longer if there is deliberate non-compliance).

The UK Government has also announced it will introduce a targeted anti-avoidance rule which means it will effectively ignore any arrangements intended to sidestep the new legislation. Therefore any proposal which suggests a way of avoiding the UK Inheritance Tax charge will need to be examined very carefully.

This is particularly the case given that inheritance tax is not an annual tax like income tax or CGT, but a one off tax charged on events such as death or on the ten year anniversary of a trust. Thus it is peculiarly vulnerable to anti-avoidance legislation as normally such legislation will catch any schemes where the donor has not yet died.

Overall the new legislation is a dramatic change for non- UK domiciled individuals and now it will be very difficult for them to avoid paying UK Inheritance Tax on UK residential property.

Although it may now be impossible to eliminate the IHT exposure there are some relatively straightforward ways of mitigating the tax liability and these include:

Gifting the property by way of a PET to the next generation – however it may not be appropriate if the children are still minors. The parents would also not be able to live in the property unless they pay a fair market rent although there are some statutory exceptions to this but advice should always be sought as this is a complex area.

For a married couple, make sure that spouse exemption is available on the first death. Obtain advice on an appropriate Will (taking into account any foreign law issues) and if possible leave your share either outright or in a special “interest in possession” Will trust for the surviving spouse which will enable the trustees to retain some control. This can then be followed by a subsequent PET to the next generation by the surviving spouse or by the trustees holding the property on trust for that surviving spouse.

Term Life Insurance – an inexpensive way to mitigate the IHT liability. This gives maximum flexibility to the owners as they can remain in the property knowing that the IHT liability is effectively taken care of on the last death. A gift can then be made to the next generation at a more appropriate time in the future rather than being forced to relinquish full ownership of the property.

Securing a loan on the property to purchase or improve the property although any growth in the value of the property will still be subject to inheritance tax. Note that taking out borrowing after the purchase of the property simply to devalue the property for inheritance tax purposes and then depositing the borrowed funds abroad will also not now work to reduce the IHT liability.

Example : Mr and Mrs Ercan, Turkish Nationals living in Istanbul

Mr and Mrs Ercan are both 50 next birthday and live in Istanbul with their two young children who are 8 and 9 years old. Following the sale of one of his businesses, Mr Ercan has decided to use some of the proceeds to purchase an investment property in London overlooking the River Thames for £6 Million.

His intention is to let the property for part of the year and spend the summer months in London with his family. His advisers have made him aware of the new UK inheritance tax legislation that now applies and it is decided that the property should be purchased in both Mr and Mrs Ercan’s names as joint tenants to make use of the spouse exemption in the event of first death.

The advisers also discuss with Mr and Mrs Ercan the idea of gifting the property to the children at some point in the future as a way of mitigating the tax however both parents feel this would be ‘some years away’ and therefore they need a more robust solution to the IHT problem.

It is therefore suggested that they consider Term Life Insurance to cover the liability and, using some simple forecasts of the likely future value of the property, they decide to take out Joint Life Second Death Life Insurance for 30 years for £4 Million for an annual guaranteed premium of £6,350.17.

The parents are now comfortable that for a relatively small cost they know that in the event of anything happening to them at any time in the next 30 years, the children will not be forced to sell the property to pay the UK IHT liability. The insurance cover is written in a simple form of discretionary trust for the children from which Mr and Mrs Ercan are excluded although they can be trustees.

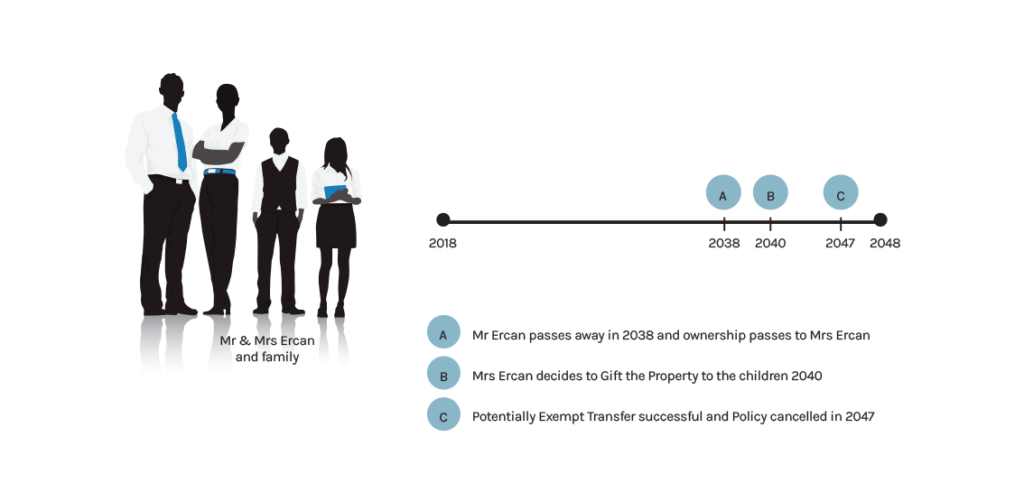

Tragically, 20 years later, Mr Ercan suffers a heart attack and dies and his widow and the now grown up children, face an uncertain future. Thankfully, ownership of the property now passes to Mrs Ercan so there is no immediate IHT liability. After a very difficult two years, Mrs Ercan decides that she will now make a gift to the children of the property under the Potential Exempt Transfer rules.

Following the completion of the PET after 7 years, ownership of the property now passes to the children and the Life Insurance is cancelled since the potential IHT liability has been removed. If, however, Mrs Ercan died in the ten years after Mr Ercan’s death, there will be a cash lump sum available to the children to pay the inheritance tax.

Important Note: Assumes both clients are non-smokers and current Inheritance Tax legislation including PET rules remain in place. Mr and Mrs Ercan and family are fictional and any resemblance to actual persons or events are coincident

30 year Life Policy for £4 Million on a Joint Life Second Death Basis – Guaranteed Premium of £6,350.17 per annum.